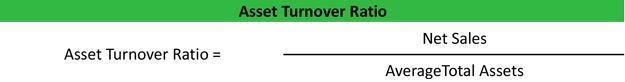

That is why the creditors look for higher current asset turnover ratios to offer loans to eligible companies. The higher the current asset turnover ratio, obviously the better it is because a higher score in asset turnover means more sales obtained for an investment of a fixed amount ( usually Rs. This gives a true value of current sales that is applicable to the measurement of the current assets turnover ratio. In order to measure the return on sales, the sales return should be subtracted from net sales. Activity ratios measure the relative efficiency of a firm based on its use of. Measuring the current assets turnover ratio in comparison to these ratios can show the performance of the company in a better manner. Activity ratios measure a firms ability to convert different accounts within its balance sheets into cash or sales. There are a host of turnover ratios that are to be measured along with the current asset turnover ratio. So, it cannot measure the efficiency of the company to service long-term debt. Making a decision depending solely upon the current assets turnover ratio can be faulty as it fails to show other features of conditions of a company.įor example, the current assets turnover ratio does not show the turnover in terms of debt. Like most other financial ratios, the current assets turnover ratio is a comparative ratio that needs to be calculated in conjunction with other forms of ratios. It provides a view into the sales figures that, in turn, can show the profitability or performance of the company in the market. The current assets turnover ratio is a signal for the future of the company that is measured in present terms. If the company fails to generate revenues through its products and services, chances are that it will go bankrupt soon in the near future. It is significantly necessary for any company to increase the sale of their products to keep moving forward and thereby generate revenues. Measuring the current assets turnover ratio helps companies stay aware of their sales power. Some of the key characteristic features of calculating current assets turnover are as follows − Characteristics of Calculating Current Assets Turnover It means that the company has made sales worth Rs. The formula used to calculate the Current Assets Turnover Ratio is as follows − of net sales, it is considered a benchmark of the quality of the company’s sales. As the current assets turnover ratio offers.

look at the current asset turnover ratio because they are interested in the performance of the company in terms of net sales.

look for a higher current asset turnover ratio because it shows that a company is strong in its fundamentals. That is why the more the amount of current asset turnover ratio, the better the ability of the company to generate sales.Ĭreditors. A higher asset turnover ratio means a better percentage of sales. The current assets turnover ratio indicates how many times the current assets are turned over in the form of sales within a specific period of time.

0 kommentar(er)

0 kommentar(er)